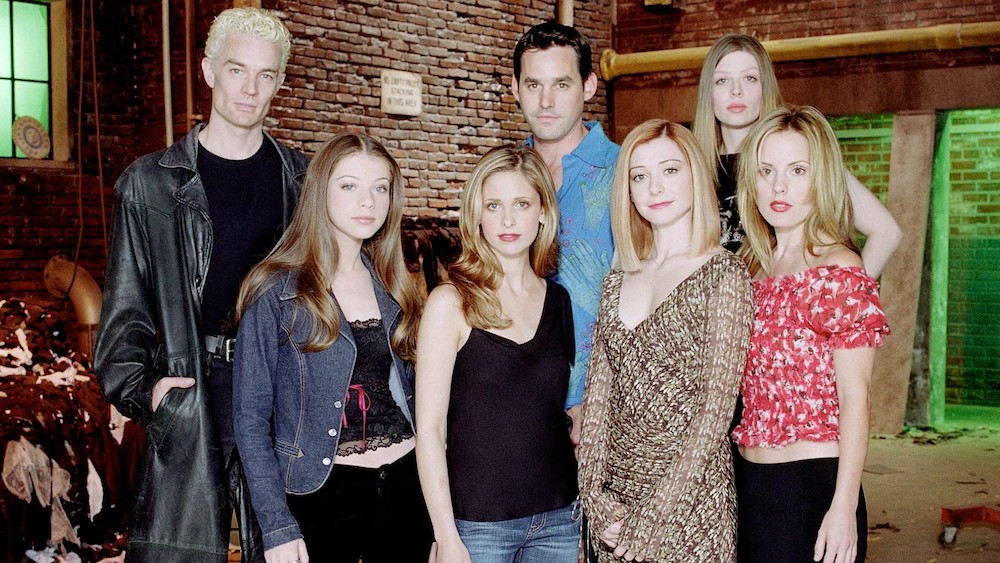

I recently finished my rewatch of Buffy the Vampire Slayer. I find it holds up surprisingly well, although much of that probably how much of it resonates with the shit I have to deal with internally. I still consider Season 4 the weakest. (Riley was never a good match for Buffy although perhaps what she needed at that point in her life and Adam was just…lame as a big bad.) And, yeah, I hold to my opinion of season 6 as the best, with caveats. First, Willow’s “magic addiction” arc seemed to come out of nowhere in contradiction to how things worked previously. OTOH, “Dark Willow” was a pretty awesome “big bad” and the after-effects in season 7 made up for much. The real “downside” of the episode was “the Trio”, who were lamer than Adam from season 4. They really don’t rate being the 2nd tier “big bads” of the season. For the most part they just stumbled through it and after the really serious threat of Glory from Season 5 they were just…yeah, lame. OTOH (again), it’s ironic that after Buffy’s repeated line about guns “never help” that it was a bad guy with a gun who came the closest to taking her out permanently (“Prophecy Girl” and “The Gift” being only temporary deaths). That it triggered “Dark Willow” wasn’t any evil plot but pure accident so The Trio again remained lame.

I continue to want to smack Xander for most of the series. Self righteous hypocrite

And there’s an ongoing refrain of:

Giles: “You have to learn to hone your instincts. They will carry you through.”

Buffy: Uses her instincts.

Scoobies: “Not like that!”

Buffy: Proves to be right.

After a while, you’d think they’d learn.

There’s also:

Scoobies: “Why didn’t you tell us?”

Buffy: (Doesn’t say it, but should) “This. Right here. How you’re acting right now. That’s why I didn’t tell you.”

All of these are annoying but, on reflection, are quite human.

One specific episode, I have drastically changed my opinion on: the Season Six episode “Once More with Feeling.” (Ths musical episode.)

Originally, I didn’t care much for it but now I think it’s easily within the top five of the entire show. It brings out so many things: Spike’s mixed feelings for Buffy (and his character arc, IMO, is the best in the show), the effect of trauma and depression that Buffy is going through due to what she’d just experienced, the many doubts Xandar was feeling about his own upcoming marriage (and he should have talked them through with Anya rather than sitting on them which could have prevented problems later). A very emotional episode with the music sliding it in like a knife between the ribs.

Not really a review but just my impressions of my latest re-watch.